ASX 200 falls 1 points to 5146 after giving up all the early gains after a high of 5198.9 as the June SPI contract expired. Banks once again the major culprits for the reversal. Gold spurts through $1300 as gold stocks ahead again. Asian markets took their cue from Japan and the BOJ with Japan down 3% and China easing back 0.4%. AUD slips to 73.9 and US futures down 67.

A stunning start to the day as SPI expiry bolstered volumes and optimism. Unfortunately, the 5200 level proved to be serious resistance and hope unwound quicker than you can say BOJ as the Asian markets fell after further signs of lunacy from Japan. Seems the stimulus package is working so well that they will continue with the same medicine. It is beginning to look a little like formaldehyde rather than stimulus juice. Unfortunately, the fear in the markets is pushing investors into the safe haven of the yen. If the EU is stuffed that rules that out and the US dollar? Well no rate rises there so the yen it is.

News today too on the continuing relative strength of the jobs numbers also dashed hopes for a rate cut from the RBA although all of the 18,000 jobs that were created were part time so no fear of a wages blow out at all. No inflation and 3.2% GDP growth all down to mining. Seems the government ‘jobs and growth’ package cannot come an election too soon. Strange that the parties spend two months promising more money for everything then the next three years taking it back off people as the budget hole grows ever larger. ‘Will no one rid me of these turbulent priests’.

Tomorrow is a Friday before a crucial week. There will be few players of any conviction as trader’s jostle to protect themselves from the Brexit risk. Gold will bubble along and once again it is the sector to be in with AUD bullion back above $1750. For the record Bitcons have gone ballistic too as they face the July contraction of the amount in circulation.

The Bitcon chart

Stocks and Sector Highlights:

- Gold stocks were again one of the few bright spots at AUD bullion pushed up to $1764. Evolution Mining (EVN)+4.7% and Northern Star (NST)+5.2% some standouts. There are an increasing number of small cap miners tapping shareholders and institutions for fresh funds. Seems there is an appetite again.

- Financials, banks and insurers weakened again with the big four down around 0.5%

- Telstra (TLS)+1.1% started to attract some safe haven buying being seen as a solid yield paying utility.

- Speculative stock of the day: Corazon Mining (CZN)+43% on news it will acquire a cobalt-copper gold project in NSW. Mt Gilmore is an advanced high grade cobalt project with gold credits. Cobalt is the sleeper given its use in lithium batteries.

Corporate News

- Syrah Resources (SYR)Trading halt as the company has announced a $194m placement following hard on the heels of their recent of take agreement with the Japanese trading house Marubeni. The deal will be down at 605 cents for 32m shares.

- Medibank Private(MPL) -5.5% following news this morning, that took the company an age to announce, that the ACCC was taking them to court over misleading and unconscionable conduct during the IPO process to keep clients in the dark about changes to the rebates on certain pathology and other items.

- Crown Resorts (CWN)+13.2% on news that James Packer is now considering breaking the company up to address the bad performance of the shares given the Macau drag. The proposed demerger will unleash value by hiving off the troubled Macau gaming business and an IPO of the local hotels into a REIT.

- Suncorp (SUN)-1.1% update the market on claims expectations following the recent East coast low at around $60m-$80m. We have another wet low heading our way this weekend so that number may rise slightly.

- Wellard (WLD) -9.6% following yet another profit downgrade. Must be some record as it is the second in a week. Even Surfstitch (SRF) -3.9% would struggle to beat that impressive record. Although they did try.

- Mt Gibson (MGX) +22.5% following an insurance settlement of $86m in cash for property damage to the Kodan Island seawall.

- APN News (APN) +1.6% has had its NZ demerger approved by shareholders. Regulatory approvals yet to be finalised.

- Primary Health (PRY)-3.1% and Healthscope (HSO)+0.4% following the ACCC investigation into the closure of Healthscope assets in Queensland and transference to Primary. The ACCC review has now been concluded and HSO has entered into undertakings to divest some of all of the residual labs in Brisbane.

Economic News

- Jobs numbers today held the market in a firm grip with the participation rate staying unchanged at 64.8 whilst the underlying unemployment number was steady at 5.7% with 17.0K jobs added. All part timer though. No full times at all.

- Australian ten year bonds fell below 2% yield

- News today from the RBA that fees the banks charge their retail customers rose 2.9% in 2015 for the third consecutive year of positive growth. Fee income from credit cards, the largest single source of fee income from households, increased strongly in 2015, domestic banking fee income grew by 3.5 % to around $12.5 billion

- RBA assistant governor Chris Kent has warned of greater risks of corporate defaults and high debt in China.

- In a Bank of America monthly survey of 213 participants managing around $US654 billion found cash allocations have surged to a fresh 15-year high, climbing to 5.7 % from 5.5 % the previous month, the highest reading since November 2001.

- New Zealand posted faster than expected growth in the first quarter as high migration boosted spending throughout the economy. GDP rose a seasonally adjusted 0.7 % in the first quarter versus the prior quarter and 2.8 % on the year.

- The odds on a local Labour election victory have blown out to 6.25.

In Asia

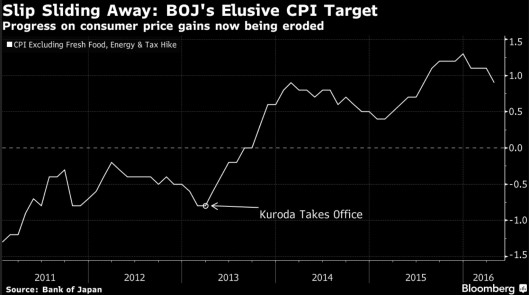

The Bank of Japan has held fire and kept rates at Negative 0.1%. That’s right. If at first that doesn’t work keep doing it. The BOJ even stuck to its optimistic forecasts on economic growth despite saying that year-on-year change in the consumer price index is likely to be slightly negative or about zero percent for the time being.

- Investors have sent a firm message to BOJ chief Kuroda that doing nothing is not an option.

- Kuroda has repeatedly said he won’t hesitate to add stimulus as needed in three dimensions, quantity, quality and the key policy rate. However, like Pandora or Spotify it seems he is close to the limit on stimulus measures. Japan’s Topix share index has tumbled 19% this year, the second-worst performance among 24 developed markets tracked by Bloomberg.

- Sun Hung Kai Properties, Hong Kong’s largest developer, is offering mortgages worth as much as 120 % of a home’s value at one of its projects as home prices have fallen 13% from September as sales slow.

Europe and US

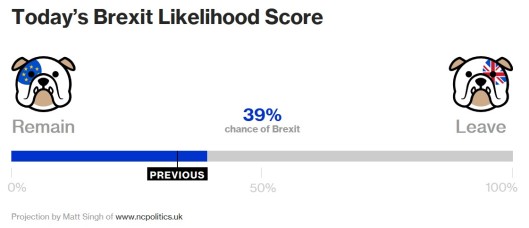

- Brexit likelihood has shifted six points in a day according to Bloomberg. Bookies now have ‘Leave’ at 13/8 with remain at ½.

The ‘Stairway to Heaven’ copyright trial continues. It is now obvious that Jimmy Page has never heard of streaming services like Pandora or Spotify as he has 4300 albums and 5000 Cds.

‘Project Fear’ from the UK conservative party and business, continues in the run up to the vote on June 23rd. Worth remembering that the UK is the world’s fifth biggest economy behind Germany, Japan, China and the US.

And finally……

A guy walks into a 7/11 store, and he grabs a single-serving meal, a single-serving drink, a single-serving toothpaste, a single-serving dessert, single-serving everything, and he goes up to the counter with it and the woman at the counter says, “Let me guess, you’re single?” And he says, “Yeah, how could you tell?” And she says, “Because you’re really bloody ugly.”

Clarence

XXXX

Get a Global take on things at http://www.ntmarkets.com